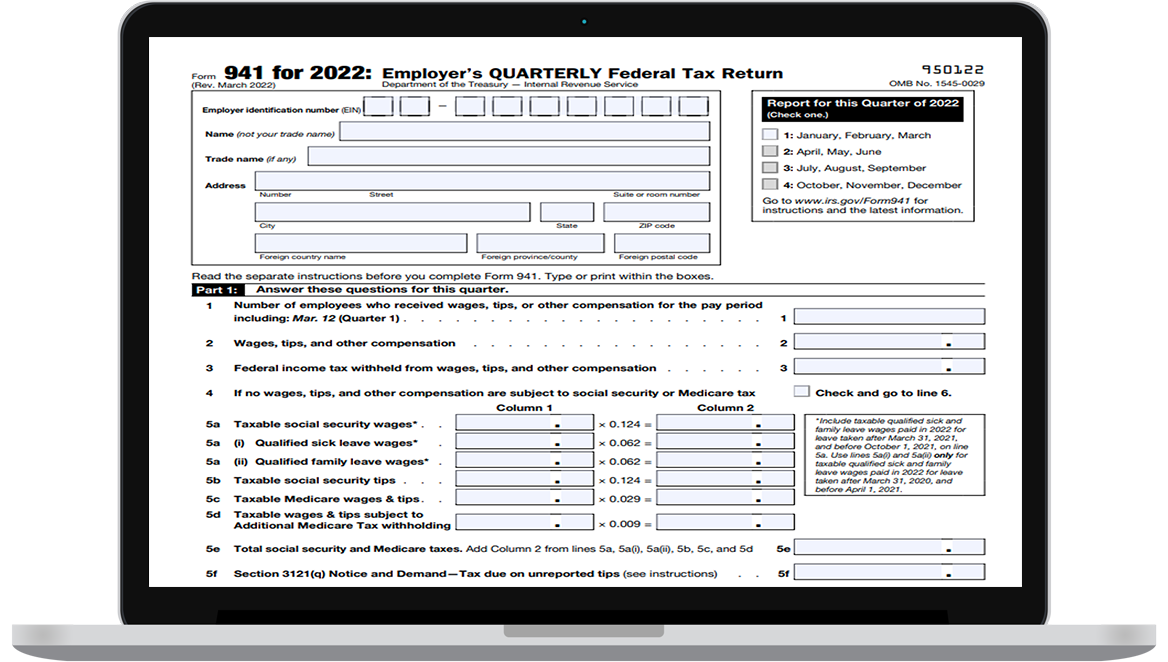

941 Form 2025 Instructions. 3, 2025, to file various federal individual and business tax returns and make tax payments. The irs form 941, employer’s quarterly federal tax return, used by businesses to report information about taxes withheld such as federal income, fica taxes, and additional tax medicare tax withheld from the employee wages with the equivalent employer contribution.

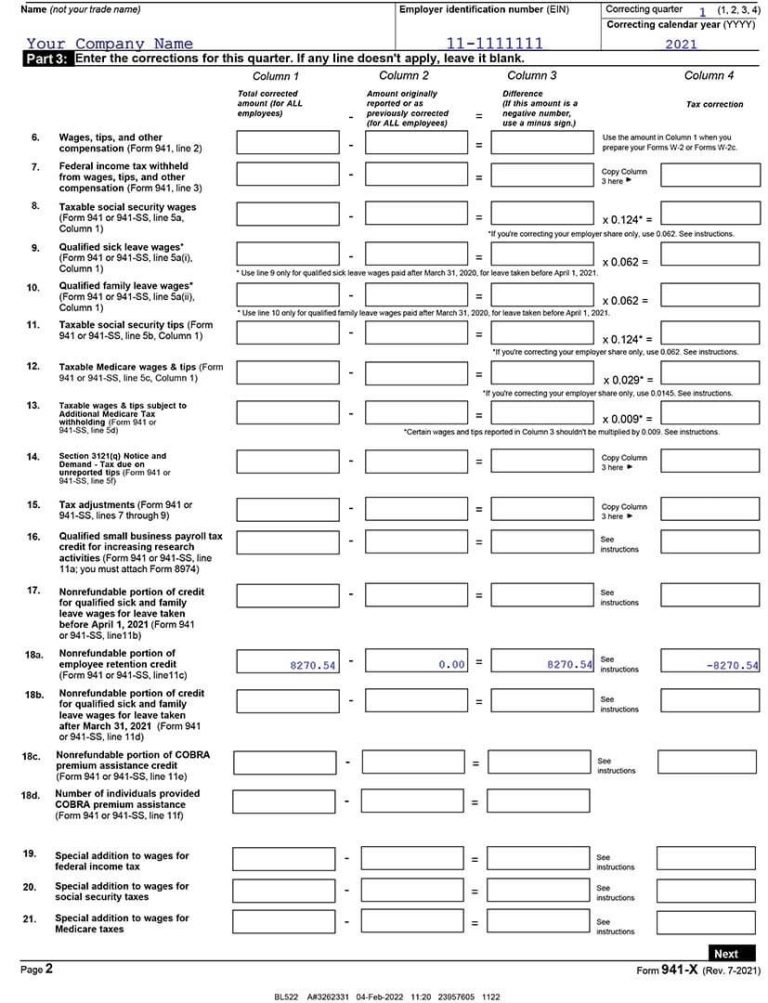

Most businesses must report and file tax returns quarterly using the irs form 941. See the instructions for form 941 if you’re eligible to claim the credit for qualified sick and family leave wages because you paid the wages in 2025 for an earlier applicable leave period.

Form 941 2025 Instructions Cory Merrie, With these 941 filing instructions, you can complete and file your returns with the irs. The irs has introduced several changes to form 941 for the 2025 tax year.

2025 2nd Quarter 941 Form Buffy Coralie, Employers must file this irs form by july 31. Final versions of the quarterly federal employment tax return for use in 2025, its schedules, and instructions were released feb.

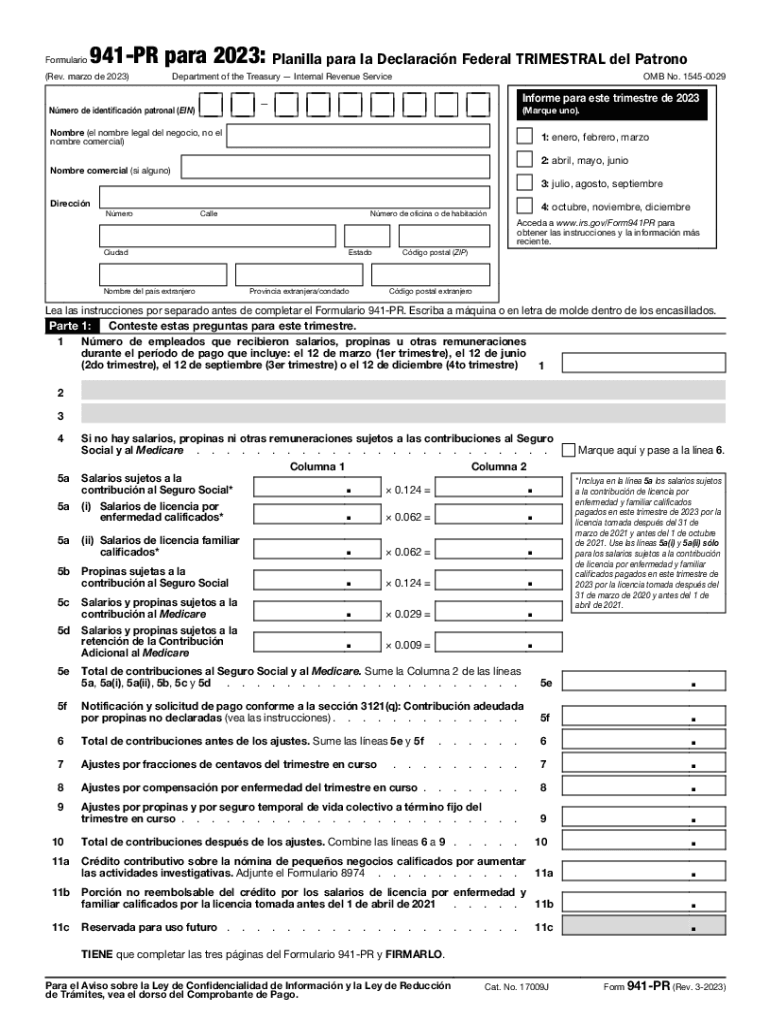

Printable 941 Form For 2025 Karyn Marylou, Anote su ein, “formulario 941” y el período tributario (“1er trimestre de 2025”, “2do trimestre de 2025”, “3er trimestre de 2025” o “4to trimestre de 2025”) en su cheque o giro. Final versions of the quarterly federal employment tax return for use in 2025, its schedules, and instructions were released feb.

941 Mailing Instructions 2025 Maris Shandee, The revision is planned to be used for all four quarters. Alternatively you can use one of our combined federal and state tax estimator to quickly calculate your salary, tax and take home pay.

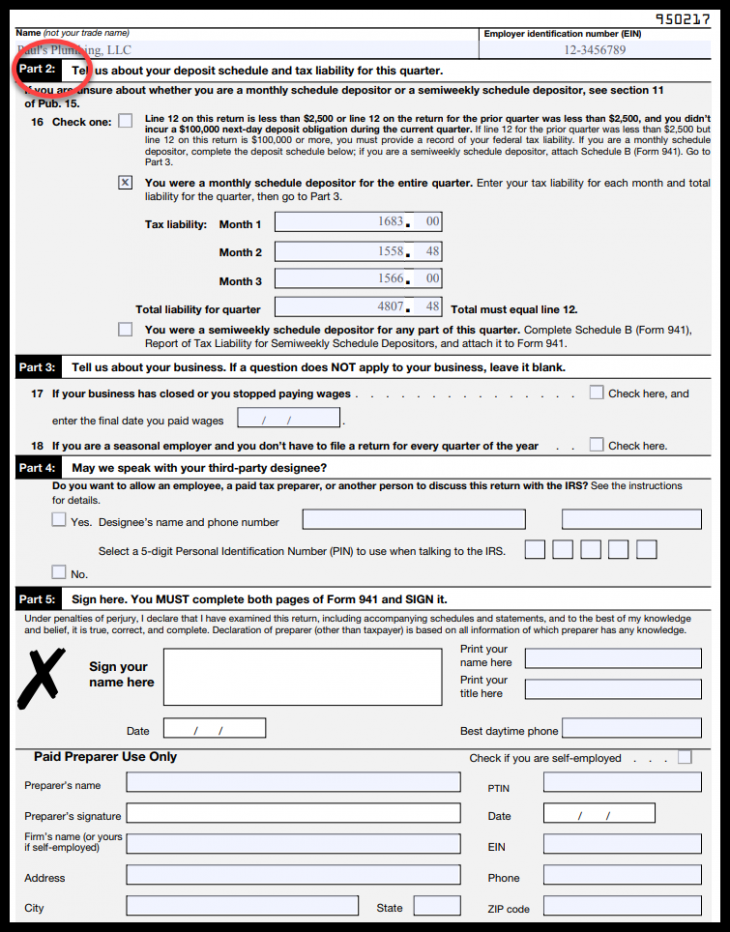

941 For 2025 Instructions Carla Cosette, Avoid major form 941 mistakes and here learn how to fill out form 941 line by line here. Irs form 941, commonly known as the employer’s quarterly federal tax return, is used by businesses to report the income taxes, payroll taxes, social security, and medicare taxes deducted.

Irs Form 941 For 2025 Instructions Ilyssa Gavrielle, 26 by the internal revenue service. If you have employees, you likely need to fill out and file form 941 each quarter.

Irs Form 941 Instructions 2025 Tamar Milicent, The irs released the 2025 form 941, employer’s quarterly federal tax return; Form 941 part 1, lines 1 through 15.

IRS FORM 941 LINEBYLINE INSTRUCTIONS 2025 Form 941 Example, Anote su ein, “formulario 941” y el período tributario (“1er trimestre de 2025”, “2do trimestre de 2025”, “3er trimestre de 2025” o “4to trimestre de 2025”) en su cheque o giro. This webinar will give you the tools to better be able to understand line by line of the form 941.

941 Form 2025 Online Filing Instructions Minny Wandis, In the top section of the form, you will provide general information about your business, such as business name, tax id, and mailing address. Updates to form 941 for 2025.

IRS Form 941 Instructions for 2025 How to Fill out Form 941, En su lugar, los empleadores en los territorios de los estados unidos presentarán el nuevo formulario 941 (sp), declaración del impuesto federal trimestral del empleador. Increased to 6.2% for both employers and employees.

En su lugar, los empleadores en los territorios de los estados unidos presentarán el nuevo formulario 941 (sp), declaración del impuesto federal trimestral del empleador.