401k After Tax Contribution Limit 2025. In 2025, you can contribute up to $23,000 to your 401 (k). The contribution limit for employees who participate in 401(k), 403(b), and most 457 plans, as well as the federal.

Workers who contribute to a 401 (k), 403 (b), most 457 plans and the federal. The roth 401 (k) contribution limit for 2025 is $23,000 for employee contributions and $69,000 total for both employee and employer contributions.

What’s the Maximum 401k Contribution Limit in 2025? MintLife Blog, This would be the result: For 2025, the 401 (k) contribution limit for employees is $23,000, or $30,500 if you are age 50 or older.

401(k) Contribution Limits for 2025, 2025, and Prior Years, The limit is the lesser of these two: For 2025, the limit for individual contributions to a traditional 401(k) is $23,000, while the cap on combined employee and employer contributions is.

401k 2025 Contribution Limit Chart, The contribution limit for 2025 is $66,000 and $69,000 for 2025. For those with a 401 (k), 403 (b), or 457 plan through an employer, your new maximum contribution limit will go up to $23,000 in 2025.

The IRS just announced the 2025 401(k) and IRA contribution limits, In '24, the internal revenue. Unless an exception applies, section 101 of secure 2.0 requires new 401(k) and 403(b) plans to automatically enroll participants at a minimum initial.

AfterTax 401(k) Contribution Definition, Pros, Cons, & Rollover, An overall limit on contributions to a participant’s account. Highlights of changes for 2025.

401(k) Contribution Limits in 2025 Meld Financial, The contribution cap rises to $7,500 for those 50 and older. For 2025, the 401 (k) contribution limit for employees is $23,000, or $30,500 if you are age 50 or older.

The Maximum 401(k) Contribution Limit For 2025, Unless an exception applies, section 101 of secure 2.0 requires new 401(k) and 403(b) plans to automatically enroll participants at a minimum initial. 401 (k) employee contribution limits.

Solo 401k Contribution Limits for 2025 and 2025, An overall limit on contributions to a participant’s account. November 1, 2025 | kathryn mayer.

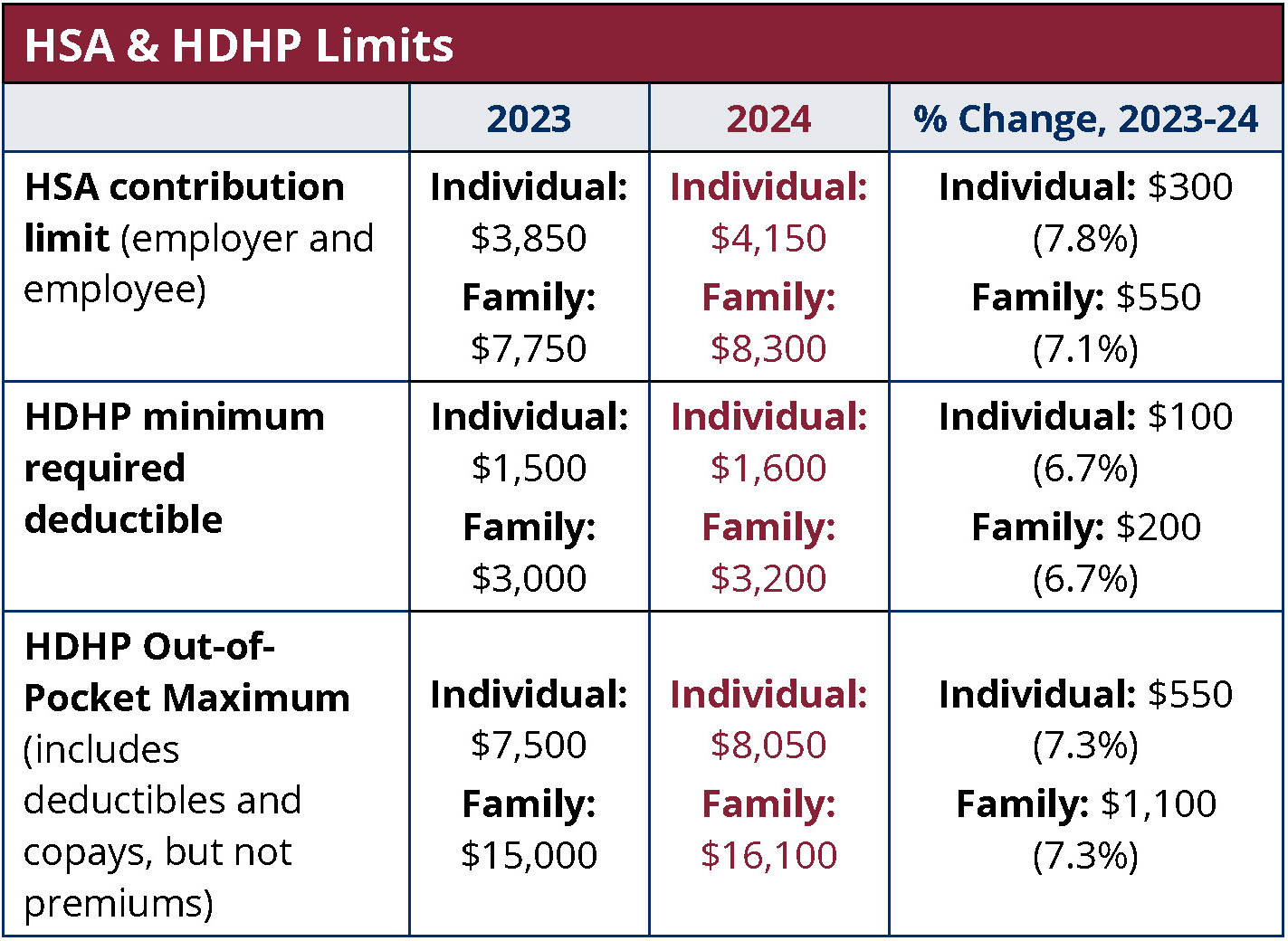

2025 HSA Contribution Limit Jumps Nearly 8 MedBen, Highlights of changes for 2025. The roth 401 (k) contribution limit for 2025 is $23,000 for employee contributions and $69,000 total for both employee and employer contributions.

2025 IRS Contribution Limits and Tax Rates, For 2025, the maximum contribution to a roth ira is $6,500 for those 49 and under. Irs announces 401 (k) contribution limit for 2025.

The 401(k) contribution limit for 2025 is $23,000 for employee contributions, and $69,000 for the combined employee and employer contributions.